The US Federal Reserve continued with its ‘pause’ at 5.25% but is still signalling higher rates without some notable change in the data.

The debt ceiling was raised at the last minute so that one can be parked for now. The Bank of England pushed the base rate up by 50bp to 5% (a level not seen since 2008) in the wake of further disappointing inflation figures. This led to further falls for Gilts, the ten-year is down 4% over the six weeks since we last reported, taking the yield up to 4.4%, also a level not seen since 2008.

As noted in our recent multi-asset commentary, this generational shift in rates has profound implications for asset allocators. UK fixed interest investments (Gilt and investment grade corporate) look so much more attractive now that they have shouldered their way back into consideration and the open question is the extent to which this undermines the case for equities.

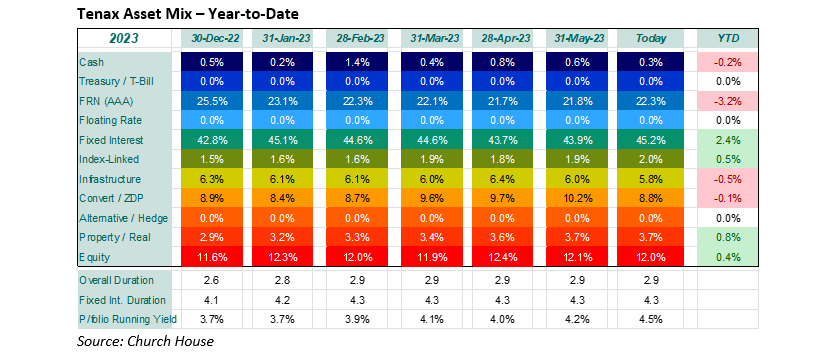

The asset mix within the Fund, shown below, reflects these considerations, with a bias towards short-dated sterling fixed interest. Clearly, we can’t be certain when the current pressure on rates will subside, but the short time to maturity of these bonds and high redemption yields (7.3% for the Fixed Interest portion) gives us a high degree of confidence in the returns.

The overall duration, and the duration of the fixed interest proportion, is unchanged over this period. The running yield has increased again with higher payments from the floating rate book and the attractive returns we are picking-up in credit. Probably the most notable new investment here was in a new bond from British Telecom with a coupon of 8.375%.

The UK equity market has had a poor six weeks, the FTSE 100 is down around 3% but further down it has been tougher, the FTSE 250 has fallen 5% and the AIM market by 7%. We have reduced exposure a shade with a sale of our remaining holding in Lloyds and one of the convertible holdings which was linked to the performance of the FTSE 100 Index.

One area of the market that is really struggling at the moment is infrastructure. Reported asset values are under pressure from valuers applying higher discount rates while the pool of natural buyers for these companies has been severely diminished by the PRIIPS regulations. The result is messy but with some areas of outstanding value. An example would be SDCL Energy Efficiency, which reported at the end of the month, including a NAV per share of 101.5p at 31st March down from 108.4p the previous year. The effect of the increased discount rate being used was a negative 7.3p. Meanwhile, the (covered) dividend target is being increased again. So, at the current market price of 75.5p, the shares have a yield of 8.25% and stand at a discount to their marked-down asset value of 25%.

Until such time as we get the (indicated by the Treasury) reform of the current regulations and guidance from the Investment Association, these massive discounts seem likely to persist. In fundamental terms (most of) these companies look outstandingly cheap. They can no longer raise equity capital for new projects and, unsurprisingly, new issues are a thing of history. London risks losing good companies like SDCL to overseas buyers with no regulatory problems, the quality of long-term assets on offer at sizeable discounts is just too tempting.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?