Another active month for the Tenax Fund has seen us continuing to build the credit investments in particular.

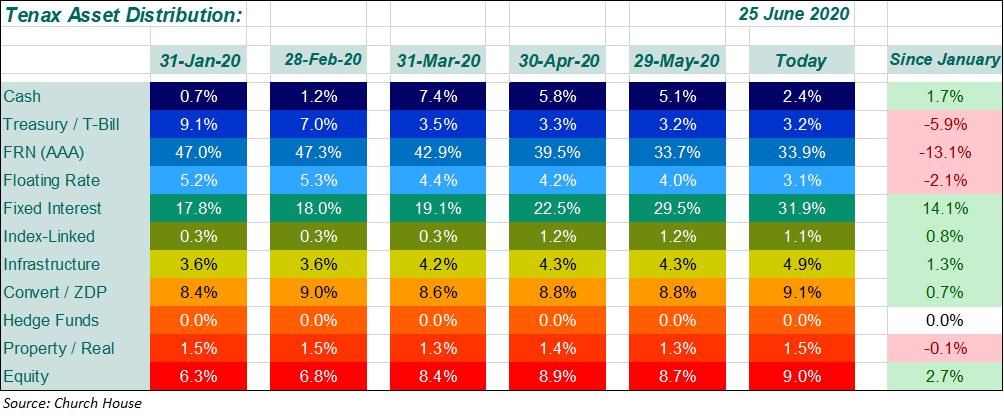

The table on the right shows the broad asset distribution at the end of each month since January as compared to the position today.

Cash and near-cash has reduced further as a proportion of the Fund while all of the other asset classes show an increased weighting. As we have said before, it is not that we no longer like the AAA-rated floating rate notes (FRNs) simply that other asset classes are now presenting opportunities for us to invest. Over this period we have also had the maturity of a long-standing FRN from ABN Amro and an attractively priced tender from Lloyds Bank for a number of their FRN issues, which we were happy to accept. In credit, we have continued to add stock from new issues (Aviva and Legal & General were notable), while adding to other holdings in the secondary market.

We have been adding selectively to stocks in the infrastructure section, in the area of availability-based infrastructure, energy storage and efficiency. We have added to holdings in BBGI, GCP Infrastructure and took stock in a placing from SDCL Energy Efficiency (we held ‘meetings’ with both of the two latter during the period, it is so important to keep in touch with companies at the moment). In property, we are gradually building a holding in Shaftesbury (two meetings with the management of this company this month), and have added further to our existing holding in a Derwent London convertible. It was a quiet month for activity in equities, we took the profit from the relatively small holding in Beazley that we had acquired around the time of their placing in May while adding further to Compass Group.

How would you like to share this?