Against the turbulent political backdrop and on-going battle with COVID-19, investment markets have been relatively calm through January.

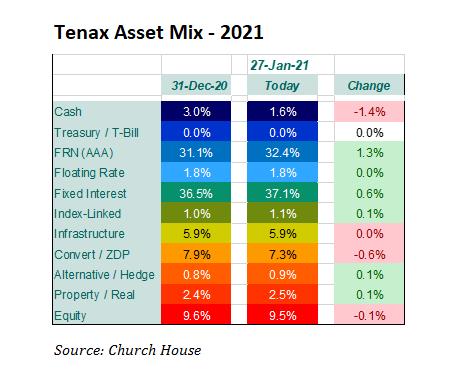

Trump’s histrionics and riots on Capitol Hill cost the Republicans control of the Senate with the loss of the two Georgian Senators. But it is not going to be plain sailing for President Biden, the Democrats’ control of the Senate is as thin as is possible and they lost seats in Congress. With volatility remaining at low levels, we have not undertaken any major shifts in asset allocation though we have been active in maintaining our cash/fixed profile. The table shows the modest changes to the overall asset mix, see right.

The floating rate note (FRN) exposure has edged-up as we purchased a new issue from the European Investment Bank (EIB) maturing in 2027, paying 100bp over SONIA. In fixed interest, we sold some of the very short-dated paper (from Barclays and Metropolitan Life), while establishing a new position in Metropolitan Life bonds with a 2027 maturity. A late addition was a new ‘sustainable’ issue from United Utilities Water Finance due in 2029.

Infrastructure exposure was reduced (though this doesn’t show on the figures above) as we took some profit from one of the recent energy infrastructure holdings. Convertibles reduce as we have sold the Orange CNV (into BT Group), which is close to maturity now. We did participate in one new issue, from Trainline, which is convertible until December 2025. International equity exposure was reduced again with the sale of our remaining Berkshire Hathaway and a further reduction in AVI Global.

How would you like to share this?