After several months of nerves over central bank policy, matters appear to have calmed down somewhat.

Jerome Powell, Chairman of the US Federal Reserve, has maintained a steady hand while the latest employment data and yesterday’s inflation figures have calmed markets. The yield on the US ten-year Treasury bond hit a peak at 4.7% in April but has now settled back to 4.3%, though that is still some way higher than the 3.9% level at the turn of the year.

In the UK, it has been a similar picture with the ten-year Gilt yield climbing to around 4.4% in late April/early May but falling back more recently below 4.1%. As in America, this is still a lot higher than end-December’s level around 3.5%. The Bank of England’s Monetary Policy Committee shifted noticeably at their most recent meeting, with two of the nine members voting for a cut in rates. Assuming the next set of UK inflation figures do deliver the lower rates expected, we must be getting close to a cut in the Base Rate.

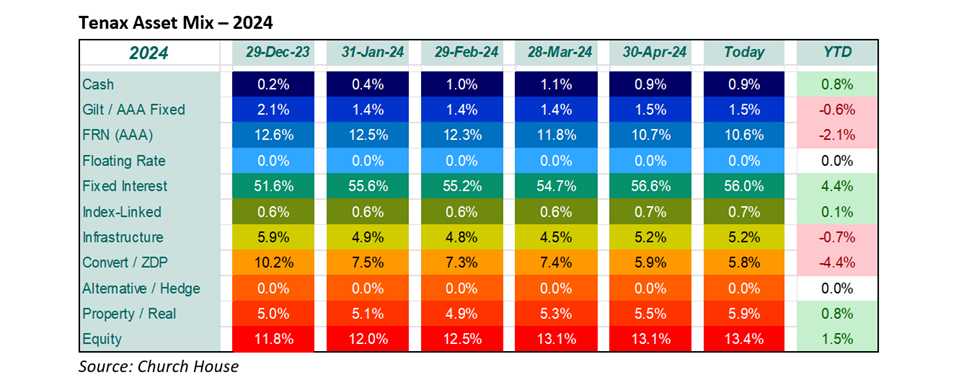

As we have said many times, we can see lots of attraction for Tenax at the short-dated end of the fixed interest market and, as shown below in the asset mix table, we are maintaining our weighting in this area.

The Fund has benefitted from its multi-asset construction over the past few months with good returns from the equity portion, which has grown as a percentage despite some sales along with better performance from Property and Infrastructure. The Gilt market is still lower over the year (in capital terms) while corporate bonds are around flat, but we are enjoying robust interest returns from this area now.

Gone from the portfolio are the John Lewis 6.125% bonds, which were close to maturity, while we have acquired an attractive new issue from Pensions Insurance Corporation of 6.875% stock due in 2034. Incidentally, the sale of the John Lewis bond removes the last holding without a credit rating. We sold the entirety of the equity holding in Schroders, whose share price has made no headway this year, but bought their new bond issue of 6.346% stock due in 2034 (though there is a call in 2029). We have trimmed the bank holdings in Barclays and Standard Chartered after a strong run, but only in a minor way as recent figures from both do justify their revival.

The proportion in Convertibles continues to shrink as these holdings are becoming very short-dated, the proportion in zero dividend preference shares (ZDP) is likely to be zero shortly as the last of these holdings is set to mature at the end of June. The Infrastructure holdings have staged something of a recovery (but there is still plenty of room for more).

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?