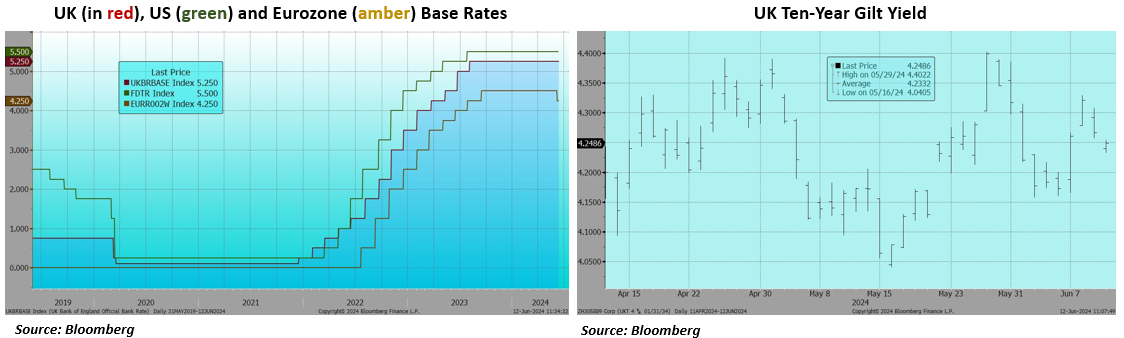

The European Central Bank (ECB) was the first of the major central banks to step off the Base Rate plateau (though the Bank of Canada beat them by a day with a cut in their rate to 4.75%).

In the UK and America, the markets are waiting for a better steer from the inflation figures. US employment figures recovered in May from an apparent slow-down in April, the US economy continues to jog along just fine. We await US inflation figures later today but, for the moment, a cut in US rates has most likely been deferred until later in the year.

It was the turn for UK inflation figures to ‘disappoint’ (though CPI being back at 2.3% is encouraging really), so the Bank of England will probably defer any reduction until later in the summer (beginning of August?). Gilt yields have continued to vacillate over the past couple of months without any real direction. This shows the yield on the ten-year Gilt (the ‘risk free’ rate!) since mid-April, blowing hot and cold, either side of 4.25%:

The Debt Management Office (DMO), which manages the sale of Gilts for the Treasury launched a new ten-year Gilt yesterday, Treasury 4.25% 2034, an issue which will probably become the benchmark ten-year bond in due course. Demand for this £11bn issue was extraordinary, with the DMO getting bids for £110bn of stock. That degree of over subscription looks like a record to me and must say something about the extent of underlying demand.

The sell-off in the NASDAQ in April proved to be quite a short-lived affair and US equities took their cue and rallied to new highs. Once again, it was all about Nvidia, which produced yet more strong figures and leapt ahead again. More of a surprise has been the steep rally in Apple (up 20% since we last wrote in this series in early May), which caught many out. The AI benefits for the suppliers is also beginning to show with HP up 30% over this period and Oracle around 15%. Also good over this period have been a few of the pharmaceuticals, Novo Nordisk on the move again and (finally) a solid period for the Swiss pharma, Roche Holding.

But equity performance is still very narrow, in America the Russell 2000 is flat for the year. The UK market is also flat for this period, seemingly unfazed by the upcoming General Election, while European markets have been knocked back by the results of the European Parliamentary elections, France most notably. In the UK, the bid for Anglo American from BHP came to nothing but elsewhere corporate financiers are returning to their offices with much more activity about, even a super-successful IPO in Raspberry Pi.

STOP PRESS:

US CPI inflation figures just out and looking encouraging…

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?