The Federal Reserve continued its corporate bond buying program after switching from buying ETF’s to purchasing individual bonds in the secondary market to create its own index.

It has only bought $1.3 billion so far but has capacity to buy $250 billion. They can buy bonds from American subsidiaries of foreign companies, which has raised questions over whether it is correctly targeted but I would point out that the BoE and ECB have already done the equivalent. They also have the capacity to buy $500 billion of new issuance but are yet to use this facility. Not surprisingly, this continues to support spreads and, in the face of volatility due to worries about a resurgence of virus cases in the US due to the incompetence of those in charge, they have been resilient.

Hertz is the biggest bankruptcy of 2020 so far and its bondholders have seen the stakes raised as it seeks to convert the master lease over its asset backed securities containing 494,000 vehicles leased to the rental company into 494,000 separate agreements so it can reject a third of them, save $80 million a month, and exit bankruptcy as a going concern. Not great for the holders of those credits.

The ECB has its own brand of financial engineering in times of duress. It’s fair to say that their PEPP has mitigated much downside risk but with it having a limited effect on stimulating inflation towards their target, it looks as though they will have to conduct more, much more, asset purchases than already committed. There is speculation about a further €1.5 trillion over and above what has already been planned (just been part approved).

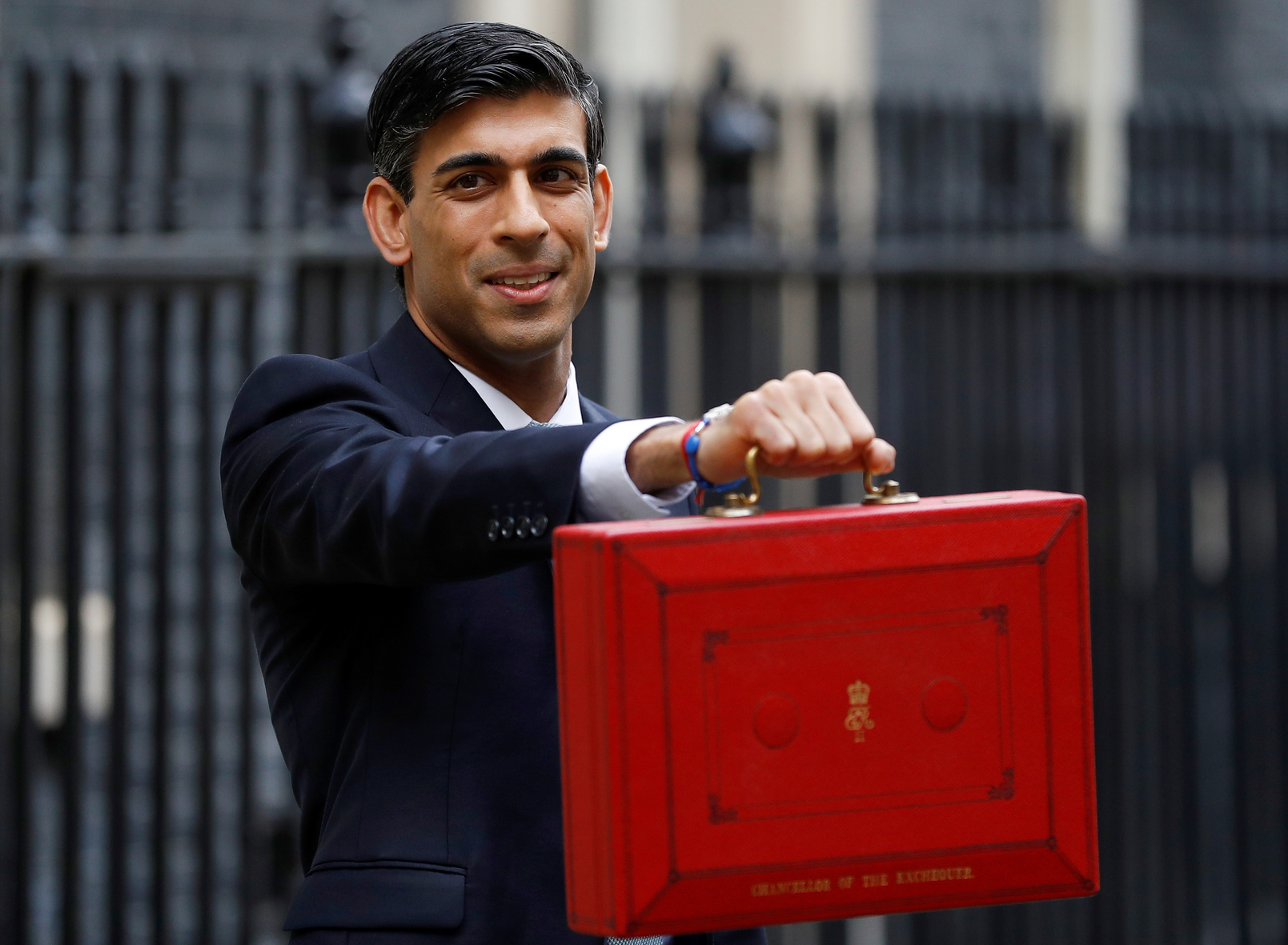

Lack of liquidity has impacted the pace of the BoE’s modest corporate bond purchase plan but is therefore supportive to spreads and they are busy enough with their other extended Gilt purchase plan. UK government debt rising to more than 100% of GDP, the first time since the 60’s, means that future generations will certainly still be dealing with it. Governor Bailey stated the obvious that the business landscape has changed to such an extent that some previously viable companies would collapse. Rishi Sunak continues to have empathy with the human side of this situation and his mini-budget of £30 billion aimed at younger generations and those sectors hardest hit had merit despite being rather cynically received by some.

The summer slowdown in issuance feels as though it has come earlier this year but as we know, 1H 2020 broke all records. BP brought the largest corporate hybrid deal ever, which was well received and has traded strongly in secondary, and just recently BBVA came to market with a 300MM GBP T2, poorly priced to offer no NIP, and only just covered the book.

How would you like to share this?