The ‘snap’ General Election was over and done quickly. Sterling didn’t blink, the Gilt market was a shade better and stocks were little changed.

Of course, this is because a Labour Party victory was widely expected and Sir Keir Starmer (along with his new Chancellor, Rachel Reeves) had worked hard to reassure (markets) in advance.

The UK economy is showing some early signs of life. After two dull years of going nowhere, recent figures for GDP are encouraging. What a gift for the new Labour administration. With inflation back at the Bank’s 2% target (though it could edge back up over the second half) and (just possibly) a cut in the Base Rate, maybe this could finally mark the beginning of a business investment cycle, something that has been so muted since Brexit. Given the fall in inflation, it is quite hard to see how much longer the Bank of England can really justify maintaining the Base Rate at the current level.

The quarter saw further gains for UK stocks to reach new high levels around the middle of May. After that it was not such plain sailing as interest rates edged higher again. The pattern of performance remains the same with smaller companies not doing as well as the bigger companies that make up the FTSE 100 Index.

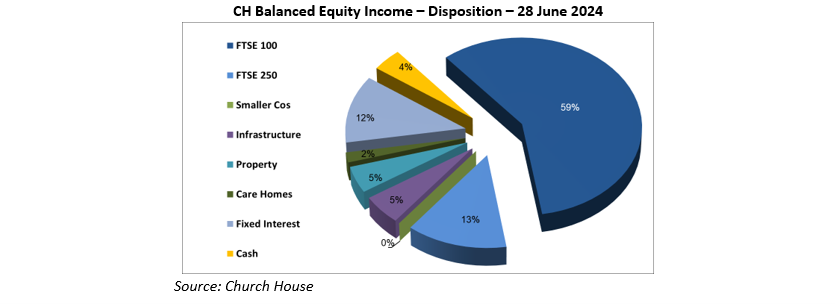

More activity than usual in the Balanced Equity Income portfolio over the last couple of weeks of the second quarter has reduced the FTSE 100 exposure (see pie chart, right) and increased the cash balance. This will not be the case for long…

As we noted in April, D S Smith had received a take-over offer from International Paper (IP) of the US (following an earlier ‘indication of interest’ from Mondi). This was then complicated by a mooted bid for IP from the Brazilian company Suzano. This latter bid, which was dependent on IP dropping its bid for D S Smith, was withdrawn in late June leaving the way open for IP to proceed. We have sold our holding in D S Smith, not wishing to end up with IP stock; it’s a shame to see them go (and another UK company disappear). A new holding in the portfolio is IG Group, a ‘fintech’ company headquartered in London, but their revenues are international (across nineteen countries). Their business generates strong cash flows and is well capitalised, with a long history of technological innovation and a good dividend yield. The list of top holdings has lost 3i Group, which we sold at the end of the period after a tremendous run in their share price, taking it to a distinctly stretched valuation. Halma reappears after recent strength in their shares, but Diageo continues to slip down the ranking. Britvic appears in the list now after their recent move on the back of two bids from Carlsberg. Britvic’s shares have jumped on the back of this, but their board is resisting the approach, correctly in our view. Both companies are bottlers for PepsiCo, Britvic having the UK contract, and Carlsberg has secured PepsiCo’s agreement to their bid. One to watch.

The above article has been prepared for investment professionals. Any other readers should note this content does not constitute advice or a solicitation to buy, sell, or hold any investment. We strongly recommend speaking to an investment adviser before taking any action based on the information contained in this article.

Please also note the value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance.

How would you like to share this?