Introducing the Human Capital Fund

An Innovative New Thematic Fund for Experienced Investors

The Human Capital Fund offers an exciting opportunity for investors seeking a fresh approach to long-term investing. This fund combines the proven management disciplines of Church House with an innovative approach to selecting companies with high-performance potential.

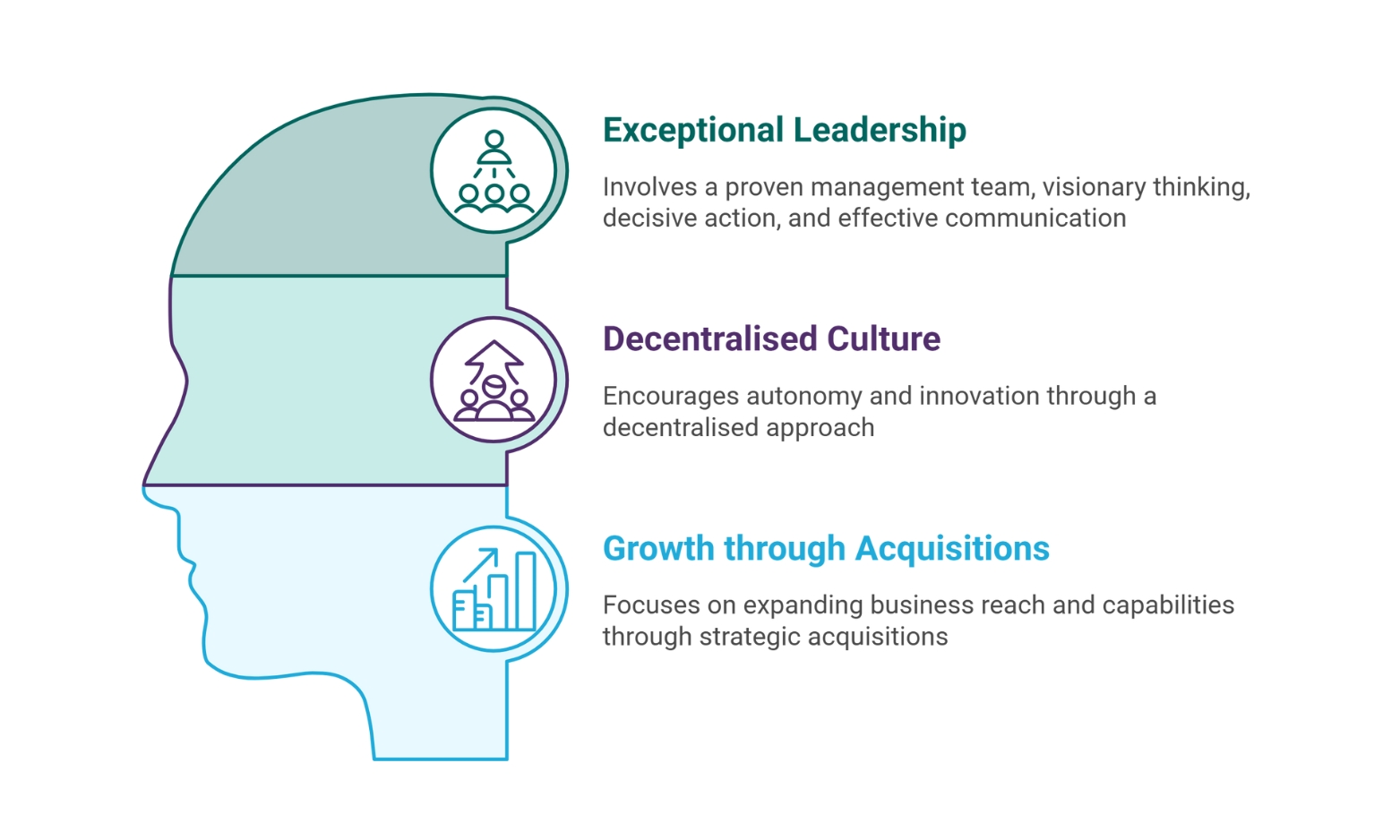

The manager aims to provide strong prospects for capital growth over the medium to long term by investing in businesses with a very specific set of characteristics.

- Highly incentivised management teams

- Very acquisitive

- Decentralised management style

- Strong financials that can support expansion